Just who Should get a parent In addition to Mortgage?

By G5global on Saturday, May 7th, 2022 in instant cash payday loans. No Comments

Paying for college was problems, and you can rising university fees can cost you indeed dont let. Based on College or university Board, the common price of a four-12 months private college or university has grown by the more than $step three,100 over the past five years. Grants, provides and work-analysis apps might help connection the new gap, but it is far better keeps an effective deals so you can right back your right up. Due to the fact some moms and dads do not want their child to take on as well of many loans on their own, the us government created Father or mother As well as funds. It stay ahead of other programs because of a predetermined interest speed and versatile installment selection. Right here we discuss stuff a parent As well as loan are, the way it operates and you will whether or not you ought to get you to.

Father or mother In addition to Loans Outlined

Why don’t we start by the basics. A pops Plus mortgage was a federal student loan given by the new You.S. Institution regarding Education Lead Mortgage program. Rather than other Lead Finance and most college loans typically, Moms and dad Plus money try issued so you’re able to mothers instead of students. Also eligible for thing is actually stepparents, centered graduate college students or any other family unit members.

Whoever removes the loan keeps really the only legal responsibility having repayments, regardless of personal plans. This is extremely unique of a parent cosigning their child’s education loan. Maximum In addition to amount borrowed ‘s the price of attendance without some other school funding received, that’ll equivalent 1000s of bucks a year. For Plus financing distributed ranging from , the speed is seven.60%. As a result, the choice to rating a grandfather Including loan should not be pulled softly.

According to Office of Federal Beginner Support, regarding the 3.5 mil parents and you can children provides lent a collaborative $83.nine million playing with Parent Along with Financing on authorities. In order to be eligible for a parent And financing, you truly must be the fresh new parent of a depending student beginner, mainly based scholar student or elite student enrolled at least half-amount of time in an acting college or university.

Your boy should also meet the standard eligibility statutes for federal student services, such proving U.S. citizenship and you may appearing you need. Men children need to be registered on Choosy Service. Like with other Lead Along with finance, you usually can not safer a parent Together with mortgage when you yourself have a bad credit score. The brand new Service off Education won’t accept a debtor having recharged-of profile, levels in choices or a good 90-big date outstanding account which have a balance regarding $2,085 or more.

Never apply for a father In addition to mortgage just because your be considered. Actually, normally recommended that students will get all the Head Financing he is eligible for earliest. This type of finance are apt to have lower interest levels and you may fees. A daddy you will constantly assist his or her kid having student loan costs, in any event.

You will want to most merely submit an application for a dad Along with financing in the event that your son or daughter demands significantly more financial aid than simply he or she has obtained from other sources. Additionally, it is extremely important one one another people and you may mothers take brand new exact same webpage on standards and fees agreements.

Experts off Father or mother Along with Fund

Understood essentially since “price of attendance without another educational funding received,” Mother or father Along with loans may be used to the tuition and you may charge, area and board, instructions, supplies, devices, transportation and miscellaneous private costs. They do not have an identical limits enforced in it once the other federal college loans perform. This makes Mother or father As well as finance an effective supplement when you have a mediocre financial aid bundle. However, you should remain cautious not to ever undertake financial obligation you won’t be able to pay right back. All of our student loan calculator makes it possible to determine how much you will be use.

As with other federal college loans, the pace toward a pops And mortgage remains a comparable on longevity of the loan. It will not change predicated on national rates of interest, the top rate or other issues. All July, the fresh new Institution out-of Studies establishes this new Mother or father Along with loan interest rate centered on you to year’s ten-12 months treasury note. The latest repaired rate of interest makes it easy to possess individuals so you’re able to expect expenses, build one another quick- and you can a lot of time-identity financial requirements and put a funds.

Father or mother And additionally loans meet the criteria for several more fees plans, among that ought to meet your needs. It liberty means they are one of the most flexible software to have financing a college education. Listed below are some your choices lower than:

- Simple Payment Plan: The most popular option, which allows to possess fixed monthly premiums having a decade.

- Finished Cost Plan: So it starts with short repayments one to slowly boost over 10 years. The theory is that, this would correspond that have broadening income levels.

- Longer Repayment Plan: This provides you with repaired otherwise finished costs more than twenty five years, rather than 10.

- Income-Contingent Repayment: Consumers shell out 20% of the discretionary income or exactly what that they had pay towards the an excellent 12-year package, any type of is leaner. However they be eligible for student loan forgiveness if they have an equilibrium after 25 years.

Cons off Mother or father And additionally Financing

Attention is not the merely expense you will have which have Moms and dad And finance. Addititionally there is that loan origination fee. The price amount are a portion of the mortgage, also it may differ depending on the disbursement time of mortgage. To own financing  immediately after , the fee are 4.248% of the amount borrowed. This means that for individuals who obtain $31,100000 having fun with a parent Plus mortgage, you might pay a charge of $step 1,.

immediately after , the fee are 4.248% of the amount borrowed. This means that for individuals who obtain $31,100000 having fun with a parent Plus mortgage, you might pay a charge of $step 1,.

That it payment try proportionately subtracted off for every financing disbursement, and therefore basically decreases the sum of money individuals need to cover education-related can cost you. Because so many personal college loans lack a fee, it’s worthy of exploring private options to decide which financing possess the lowest credit costs.

Already put from the 7.60%, Parent As well as fund yes don’t have the reasonable rate available to choose from. For those who have strong borrowing and qualify for a much better rate, you could imagine a unique financing that can cost not so much during the tomorrow. Head Subsidized Finance currently bring a good 5.05% interest, if you find yourself Direct Unsubsidized Funds is located at 6.60%. While doing so, some individual loan providers possess rates as little as 2.795%.

Moms and dad And additionally financing installment normally begins within 60 days of financing disbursement, however, consumers have the choice to postponed installment. This will past when you’re their child is still at school and you can to have half a year shortly after he/she graduates or if perhaps new student drops less than a 1 / 2-big date subscription updates. Not simply is this much less go out than borrowers from other mortgage programs found, however, interest also consistently accrue during the deferment months.

Simple tips to Sign up for a pops Including Financing

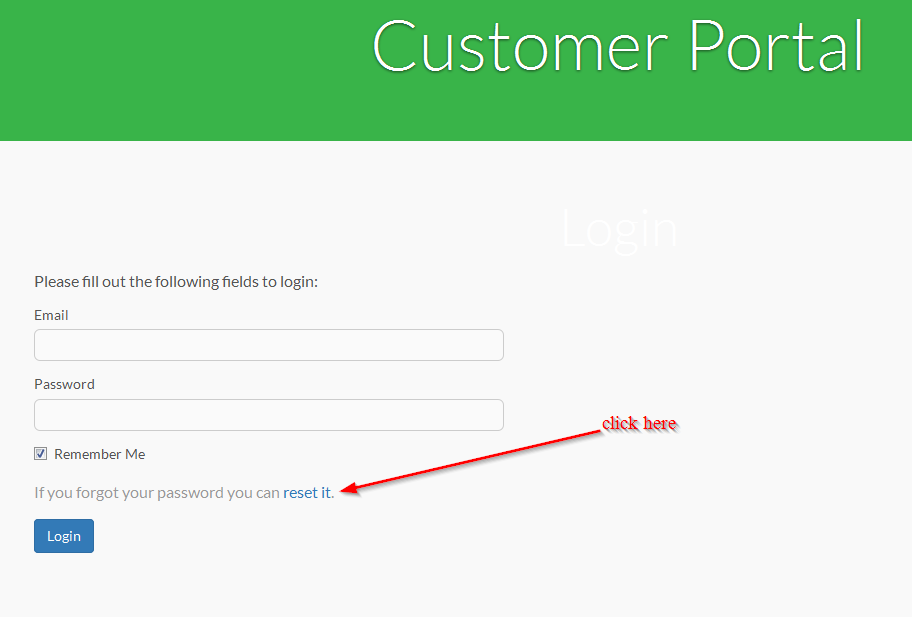

In the event that a parent In addition to loan seems right for you, document the brand new 100 % free App getting Government Scholar Support (FAFSA) on FASFA.ed.gov. According to the school’s software processes, might demand the loan out of and/or school’s school funding place of work.

For folks who discover recognition to have a pops Along with loan, you will get an immediate In addition to Financing Master Promissory Notice (MPN). You will need to opinion and you may sign the MPN in advance of sending right back. Financing are generally delivered to the college, nevertheless otherwise your child may located a check. The money is employed for educational and you can college-related purposes.

Leave a Reply