What Is A Statement Of Retained Earnings

By G5global on Tuesday, March 30th, 2021 in Bookkeeping. No Comments

Content

- How Do You Prepare A Retained Earnings Statement?

- Understanding Statements Of Retained Earnings

- Benefits Of A Statement Of Retained Earnings

- Retained Earnings Vs Owners Equity

- Are Retained Earnings A Type Of Equity?

- The Statement Of Retained Earnings May Be Useful For Your Business

- How To Look At Financial Statements To Invest In Stocks

The notes on the Statement of Retained Earnings is very simple and straight forward. It is very critical to have a better understanding of Retained Earnings as it is one of the very important statements that investors look at when reviewing the annual AFS. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. This document/information does not constitute, and should not be considered a substitute for, legal or financial advice.

Others might split the gains, or distribute the surplus to investors. Check out our list of the 37 basic accounting terms small business owners need to know. Retained earnings are listed under equity because they are earnings owned by the company, rather than assets that may be in the company’s possession currently but not owned outright. No matter how you decide to use your retained earnings, it’s important to keep your books straight and make sure you report all income and expenses in the right place. If the company faces a net loss then the net loss will be subtracted from the beginning retained earnings amount.

How Do You Prepare A Retained Earnings Statement?

The statement of retained earnings can help investors make important decisions, such as whether they want to buy, sell or hold on to stocks. For example, if an investor sees high retained earnings, they might expect the company to grow within the next period, which could help them decide to buy more shares of stock. The accumulated retained earnings balance for the previous year, which is the first line item on the statement of retained earnings, is on both the balance sheet and statement of retained earnings. If your company has a dividend policy and you paid out dividends in that accounting period, subtract that number from net income.

- Retained earnings are the profit that a business generates after costs such as salaries or production have been accounted for, and once any dividends have been paid out to owners or shareholders.

- Yield is variable, fluctuates and is inclusive of reduced expense fees, as determined solely by the fund manager.

- When it comes to investors, they are interested in earning maximum returns on their investments.

- Retained earnings during a month, quarter, or year is the revenue the company collected beyond its expenses, which it did not distribute to owners.

- To calculate your retained earnings, you’ll need to produce a retained earnings statement.

- During the year Nova declared and paid a divided of $250,000 to its stockholders.

- You could have negative retained earnings if you have a net loss and negative or low previous retained earnings.

If you look at the bank statement for your savings account, it explains how your balance changed during the month. It shows all of the deposits and withdraws that occurred during the month. Taking the balance at the beginning of the month, adding the deposits, and subtracting the withdraws would result in the balance at the end of the month. I did not include aprior period adjustmentin this example because they aren’t typically very common.

Understanding Statements Of Retained Earnings

Knowing and understanding the retained earnings figure can help with business growth. But beyond that, those who want to invest in a business will certainly expect the owner or manager to understand its value because they’re not just investing in the business; they’re investing in them too. And if they aren’t taking care of basic accounting matters, then it could be viewed as a sign of a poorly-run operation. If the business is brand new, then the starting retained earnings figure will be $0. They’re sometimes called retained trading profits or earnings surplus.

- All financial products, shopping products and services are presented without warranty.

- However, after the stock dividend, the market value per share reduces to $18.18 ($2Million/110,000).

- See program disclosures and the applicable fund prospectus before investing for details and other information on the fund.

- Assets are the items of value that you own; liabilities are what you owe; and equity is the money you have left after paying down debts.

- If your company is very small, chances are your accountant or bookkeeper may not prepare a statement of retained earnings unless you specifically ask for it.

- An amount is set aside to handle certain obligations other than dividend payments to shareholders, as well as any amount directed to cover any losses.

Subtract dividends from your Step 4 result to calculate the current period’s ending retained earnings. Write “Ending retained earnings” in the first column and the amount in the second column on the fifth line of the statement. Continuing the example, subtract $1,000 from $60,000 to get $59,000 in ending retained earnings. Write “Ending retained earnings” in the first column and “$59,000” in the second column. Retained earnings, sometimes, can be negative as well and when a company has a net loss, it has to be recorded in the retained earnings.

Benefits Of A Statement Of Retained Earnings

It’s important to understand that retained earnings are not the same as cash retained in your business. In order to track the flow of cash through your business — and to see if it increased or decreased statement of retained earnings over a given period of time — you will need to review your statement of cash flows. Dividends are treated as a debit, or reduction, in the retained earnings account whether they’ve been paid or not.

- The difference between the beginning balance and the ending balance indicates the change in retained earnings during the accounting period.

- If your business is publicly held, retained earnings reflect any profit that your business has generated that has not been distributed to your shareholders.

- The statement of shareholders’ equity can be used in lieu of the statement of retained earnings.

- Another advantage of healthy retained earnings is there is no involvement of external agencies to source the funds from outside.

- Sage Intacct Advanced financial management platform for professionals with a growing business.

Deciding how to invest net income is an essential task for any small business owner and retained earnings can tell you how much you’re working with before you make any major investments. Or you can use retained earnings to pay off debts and take that stress off your shoulders. Now, let’s say you’ve struggled a bit this year and your retained earnings are in the negative. You have beginning retained earnings of $12,000 and a net loss of $36,000. If you’re a new business, put in a $0 for retained earnings, and if your retained earnings were in the negative, make sure to mark that as well. You could have negative retained earnings if you have a net loss and negative or low previous retained earnings. Let’s say, for example, you own a construction company, and you want to invest in profit-producing activities using your retained earnings account.

Retained Earnings Vs Owners Equity

If your company is very small, chances are your accountant or bookkeeper may not prepare a statement of retained earnings unless you specifically ask for it. However, it can be a valuable statement to have as your company grows, especially if you want to bring in outside investors or get a small business loan. Discuss your needs with your accountant or bookkeeper, because the statement of retained earnings can be a useful tool for evaluating your business growth. The statement of retained earnings can help investors analyze how much money the company’s shareholders take out of the business for themselves, versus how much they’re leaving in the company to be reinvested. However, the statement of retained earnings could be considered the most junior of all the statements.

The retained earnings are usually kept by a business in order to invest in future projects. The statement is intended to show how a business will use these profits for future growth.

Are Retained Earnings A Type Of Equity?

Free Financial Modeling Guide A Complete Guide to Financial Modeling This resource is designed to be the best free guide to financial modeling! Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She has consulted with many small businesses in all areas of finance. She was a university professor of finance and has written extensively in this area. If you are your own bookkeeper or accountant, always double-check these figures with a financial advisor. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Join our Sage City community to speak with business people like you.

What are the three classifications of restrictions of retained earnings?

Restrictions on retained earnings can be classified into three classifications: legal, contractual, and discretionary.

The fund cannot guarantee that it will preserve the value of your investment at $1 per share. An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund and you should not expect that it will do so at any time. ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. The reserve account is drawn from retained earnings, but the key difference is that reserves have a defined purpose, like paying down an anticipated future debt.

The Statement Of Retained Earnings May Be Useful For Your Business

The statement of retained earnings is one of four main financial statements, along with the balance sheet, income statement, and statement of cash flows. In smaller companies, the retained earnings statement is very brief.

So I think I've grasped the basic concepts of an income statement, balance sheet, & statement of retained earnings. It only took 2 hours…?

— Brandon Mendiola (@MendiolaBrandon) February 7, 2013

This shows exactly how your contributed capital in the business impacts the total equity in the business. If you issue stock in the business, the changes in that stock would also appear in the expanded statement of retained earnings. Suppose your business shows a net profit on your profit and loss statement of $50,000 for the year 20XX. Of that $50,000, you owe $15,000 in dividends to your shareholders . At the end of the period, you can calculate your final Retained Earnings balance for the balance sheet by taking the beginning period, adding any net income or net loss, and subtracting any dividends. If the hypothetical company pays dividends, subtract the amount of dividends it pays from net income.

How To Look At Financial Statements To Invest In Stocks

Some companies, like those in technology, may try to keep higher retained earnings in order to invest in new equipment more regularly than other industries. Consider your company’s investment objectives and relevant risks, charges, and expenses before investing. Review the background of Brex Treasury or its investment professionals on FINRA’s BrokerCheck website. What a business does with retained earnings can mean the difference between business success and failure, especially if the business is looking to grow. Keir Thomas-Bryant Keir is Sage’s dedicated expert in the small business and accountant fields.

That is the closing balance of the retained earnings account as in the previous accounting period. For instance, if you prepare a yearly balance sheet, the current year’s opening balance of retained earnings would be the previous year’s closing balance of the retained earnings account.

Takachiho Koheki : Financial Results for the Second Quarter of FY2021(Consolidated) – marketscreener.com

Takachiho Koheki : Financial Results for the Second Quarter of FY2021(Consolidated).

Posted: Fri, 10 Dec 2021 00:12:13 GMT [source]

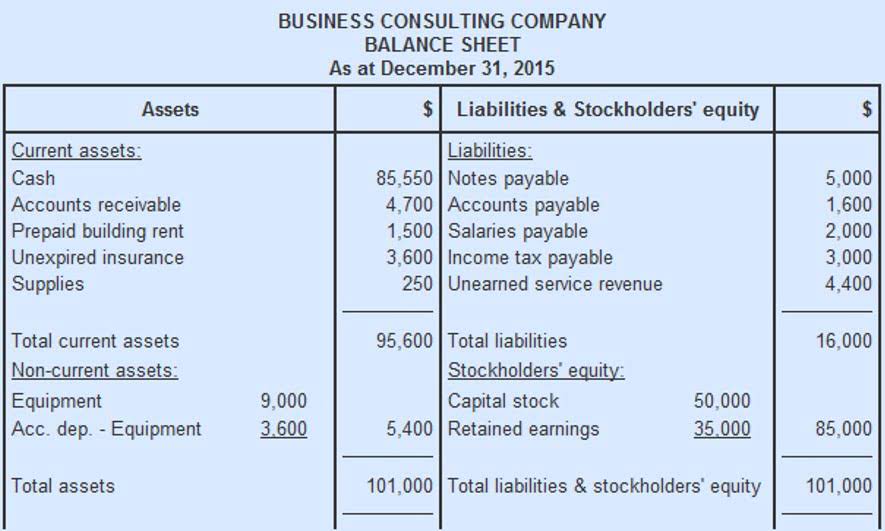

The last line on the statement sums the total of these adjustments and lists the ending retained earnings balance. There are businesses with more complex balance sheets that include more line items and numbers. Subtract a company’s liabilities from its assets to get your stockholder equity.

When u find out that statement of stockholder's equity is the same as statement of retained earnings haHA aren't I so relevant to ur life rn

— Darb (@drabcon) September 21, 2015

If your company earns a profit, you can choose to either distribute the profits as dividends to owners or reinvest the profits in your business. The amount of profit you’ve kept since your company’s beginning is called your retained earnings. Your statement of retained earnings shows the change of your retained earnings account between two periods and the items that affect the change.

Finally, there may be some accumulated gains or losses from parts of the business that don’t show up in the retained earnings account. If you had all of this other information, you could calculate a pretty good estimate of the retained earnings balance. Therefore, calculating retained earnings during an accounting period is simply the difference between net income and dividends. Therefore, the retained earnings value on the balance sheet is a running total of additional gains minus dividends. The difference between the beginning balance and the ending balance indicates the change in retained earnings during the accounting period. Is part of a company’s financial statement, which explains any change in retained earnings during an accounting period.

CEU’s retained earnings – The Manila Times

CEU’s retained earnings.

Posted: Mon, 22 Nov 2021 08:00:00 GMT [source]

The beginning period retained earnings are thus the retained earnings of the previous year. Retained earnings are calculated by subtracting dividends from the sum total of retained earnings balance at the beginning of an accounting period and the net profit or (-) net loss of the accounting period. Since cash dividends result in an outflow of cash, the cash account on the asset side of the balance sheet gets reduced by $100,000. Also, this outflow of cash would lead to a reduction in the retained earnings of the company as dividends are paid out of retained earnings.

Leave a Reply